Take a look at the Anglo Saxon Inventory Valuation Business Memento at https://www.odoo.com/documentation/user/11.0/inventory/management/reporting/valuation_methods_anglo_saxon.html

The Stock Interim Accounts are used to stored the value of goods not yet Billed (for goods you receive) or not yet Invoiced (for goods you deliver) until there is a corresponding Bill or Invoice entered.

Other names for these accounts are:

You can check these accounts regularly to make sure you have entered all Bills and created all Invoices.

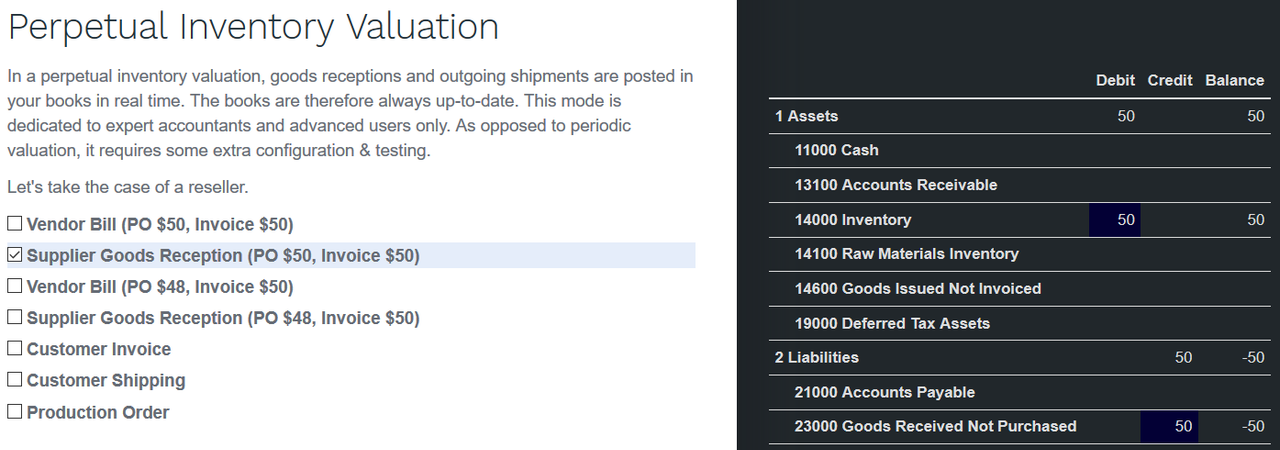

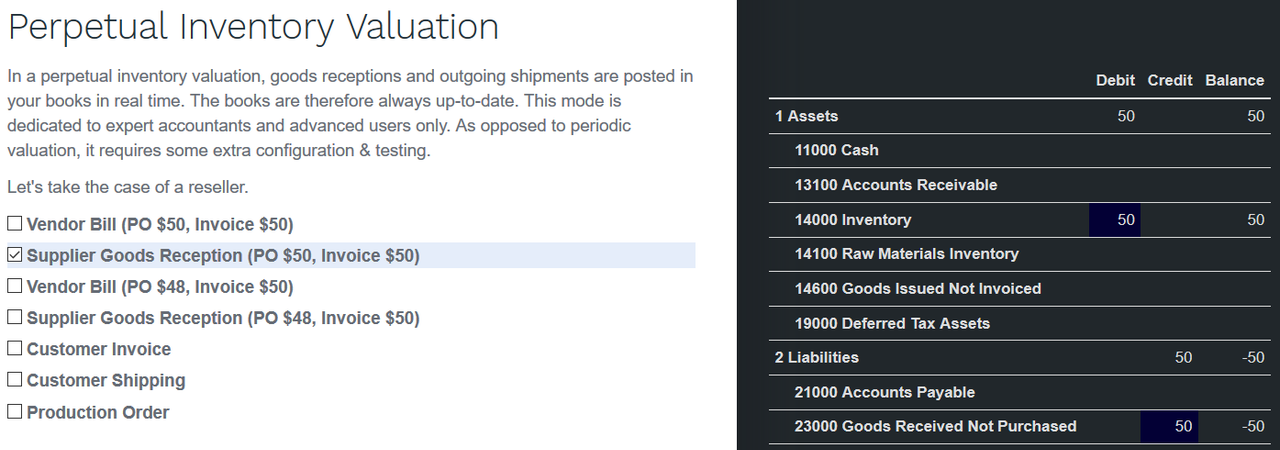

When you receive items:

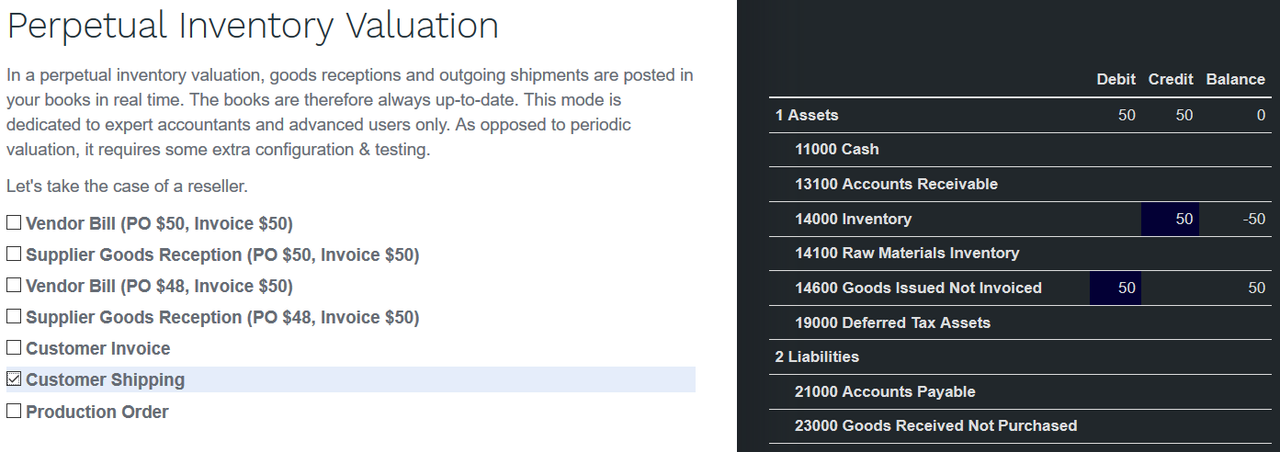

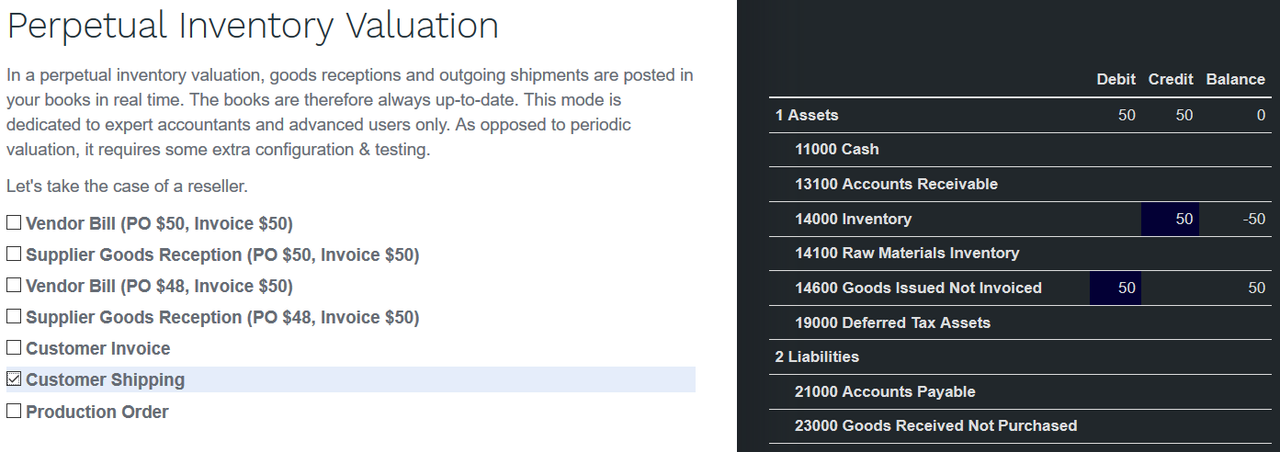

When you send items:

The Expense Account on a Product or Product Category should be used to book Cost of Goods.